How To Start A Photography Business in 2024

After almost a decade in business and meeting other photographers, I frequently get the question: “How do I start a photography business?” I hate having to break it to them that about 20% of the job is the Fun Stuff, but the other 80% (the Business Stuff) takes up most of your time!

This post assumes that you already have the Fun Stuff handled – camera, lens, social media profiles. I’m going to focus on the things no one tells you about when you first start your business: insurance, taxes, and websites.

Disclaimer: while I did take a couple classes on finances in college thanks to an engineering degree, I’m not your accountant or your lawyer. Make sure to check in with professionals before making any financial or legal decisions.

How to set up your photography business legally

Everyone has to start somewhere, but offering up cheap photo sessions for cash on FB isn’t a sustainable business model, nor is going to work for very long for your clients.

By doing the work (and spending the money) to get your business set up as an Actual Business, it’s going to help you:

- Be taken seriously as a professional photographer

- Allow you to become a full-time photographer, bringing in a full-time revenue.

Not only do you protect yourself by setting your photography business up legally, you legitimize your place in the industry. Clients will feel more confident in the process, which will help you charge higher rates for your services.

Employer Identification Number (EIN)

An Employer Identification Number (aka EIN) is issued by the IRS, can be used in place of your social security number for tax related business purposes. Examples:

- W-2s. If you’ve worked as a contractor, or for a business, you may be asked to fill one of these out.

- Banking. Helpful when setting up Stripe, Square or PayPal business accounts (see below).

And it’s free! You can apply for an EIN for your photography business with the IRS at this link.

Sales tax for photographers

Sales tax on photography services is very much location dependent. Some states only require sales tax on physical product, some only on the products you deliver, some only if you hit a certain threshold of revenue.

You will want to check with your local state/city/county officials to find out if you need to charge sales tax on your photography work, and how to submit your sales tax returns.

Contracts

Get your contracts in place as soon as you take your first client!

If you aren’t in a position to hire a lawyer to draft a contract, TheLawTog comes highly recommended by photographers. When I started, I used a contract template from the Professional Photographers Association (PPA). These are included as a complimentary benefit to a PPA membership, so it can be a great way to start!

Photography business insurance

Photography equipment insurance

Photography equipment insurance covers damage and theft of your photography equipment used for business purposes (details dependent on your policy – talk to your agent). Even if you have a rider on your homeowner’s insurance to cover your photography equipment, it may be void if you use that equipment for work.

A PPA membership also includes up to $15K in equipment insurance, which is a great option for a new photographer. Check with the insurance company that covers your home and vehicles, as most insurance companies also carry business insurance.

Photography liability insurance

Photography liability insurance may help cover you if someone is hurt during a session, or if you accidentally damage someone’s home or property during the session. Lightstand fell over and tore a painting? Client broke their ankle during their family session? Certain venues and private locations may require proof of liability insurance for vendors (including photographers).

Website

Photography website

Your photography website and web presence is your business storefront. By hosting a space for your clients off social media, you have more control over what you provide to your clients, and how you can be reached.

I know: the thought of building a website can be intimidating! But I promise it’s worth it in the end – not only will you have more control over your internet presence, but you will also have more access to insights that can help you better serve your clients.

My recommended website builders for photographers are:

- Squarespace

- Showit

- WordPress with a theme (Sightsee Designs, Style Cloud)

SEO

Do you have a website, but have no idea how to get it to show up on the first page of Google? Just because you set up a website, that doesn’t guarantee you’ll show up on the first page of results!

For some quick tips to get you started with SEO, download my 3 Day Challenge To Start Ranking on Google!

Gallery host

Once you start photographing clients, you’ll need the ability to transfer images to your client. While in the past this could have taken the form of a USB or CD, most photographers now deliver their images online.

My recommended gallery host sites:

- Pic-Time (referral link)

- Smugmug

- Pixieset

- Shootproof

Customer Relationship Management (CRM)

When I started my business almost ten years ago, I tried keeping everything on paper to keep my costs down. Paper contracts, checks, cash. But I quickly realized how hard it was to get a paper contract signed ahead of time, and I hated having to remind my clients to bring a check to their session.

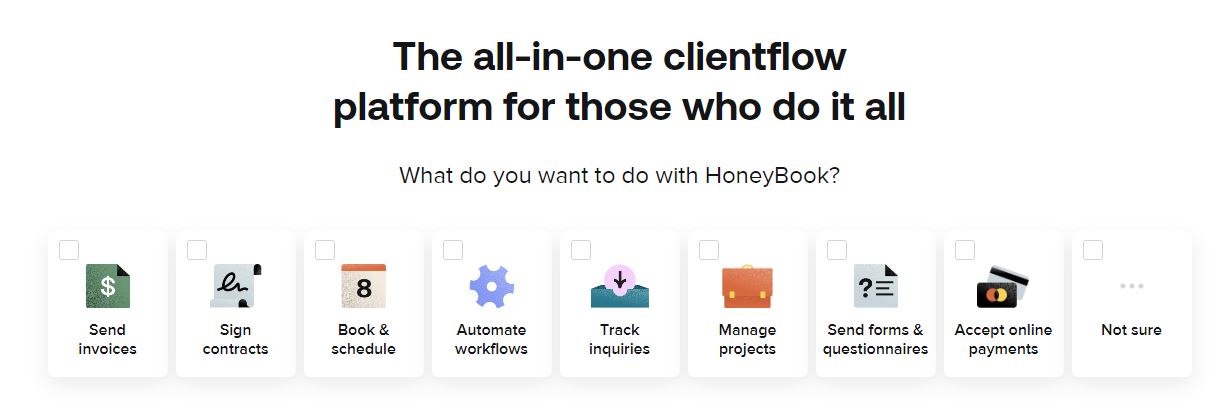

One of the best steps I could have taken was to subscribe to an online customer relationship management (CRM) software. I am able to send contracts for e-signature, get invoices paid online, and keep track of my inquiries.

My recommended photography CRMs are:

- 17hats (referral link)

- Honeybook

- Sprout

- Tave

Business Financials

Square/Stripe/Paypal vs Venmo

I know: credit card processing fees are just another expense, in a long line of expenses. But that 3% brings me:

- A professional experience for my clients. Why, yes, you CAN pay by credit card!

- Easy to access reporting for sales tax and year end taxes

- A “set it and forget it” method of invoicing that results in my getting paid quicker, with fewer reminders

Self Employment Taxes for Photographers

The transition from being an employee to being self-employed can be a rough one, especially when it comes to taxes. Since you no longer have an employer paying for social security, etc, you’ll be on the hook for that yourself. And if you wait to pay your entire tax bill in April…you may end up paying even MORE, thanks to underpayment penalties.

To avoid underpaying on your taxes, you may need to make quarterly payments directly to the IRS. This page from the IRS explains the process, including how to make estimated tax payments.

Hire an accountant! (Or at least Quickbooks)

Breathing into that paper bag yet? I know! Starting a photography business can quickly go from “fun side hustle” to “mountains of paperwork and not-fun expenses”.

To take the stress out of the financial side of the business, I highly recommend finding a small business accountant in your area to help you calculate (and even submit) estimated tax payments, year end tax documents, along with any sales tax payments you may need to make.

How much does it cost to start a photography business?

| ITEM | COST |

| Contracts | $350 |

| Business Insurance | $350 |

| Website | $300 |

| Gallery Host | $400 |

| CRM | $350 |

| Accounting | $350 |

| TOTAL | $2100 |

About Me

Hey! I’m Liz. I’m a family and newborn photographer, with almost 10 years experience. I’ve seen a lot of photographers crash and burn in that time, not realizing the full extent of what it takes to run a photography business!

I’m here to help photographers – especially family and newborn photographers – find their way in a chaotic world of photography business advice.

For more info on SEO, use the link below to sign up for my newsletter!